When the money stops flowing — the party is over.

This is precisely what you don't want to happen, especially when you are in the middle of financing or refinancing a commercial property, expanding your business, or settling urgent and timely financial matters.

Whether you qualify for a bank loan or not, another option exists that can move you forward with your financial endeavors: An option that provides immediate capital for your time-sensitive or complex cash-out transaction.

Junior Financing 101

Knowing how second debt financing operates is essential if you’re ready to jump at the chance to secure a second trust deed private loan from a leading investment firm.

In its pure form, all deeds of trusts (whether first or second liens) are legal documents of a financial loan agreement between two parties. The deeds of trusts are promissory notes that the borrower will repay the lender in a fixed timeframe. In the case of real estate, the property is used by the lender as a pledge of security.

The second deed of trust allows a property owner to borrow additional funding beyond and subordinate to the first trust deed. The second trust deed effectively acts as a junior lien to the first. Acquiring junior debt on your asset using private party money usually is quick, efficient, and reasonably priced.

Significantly More

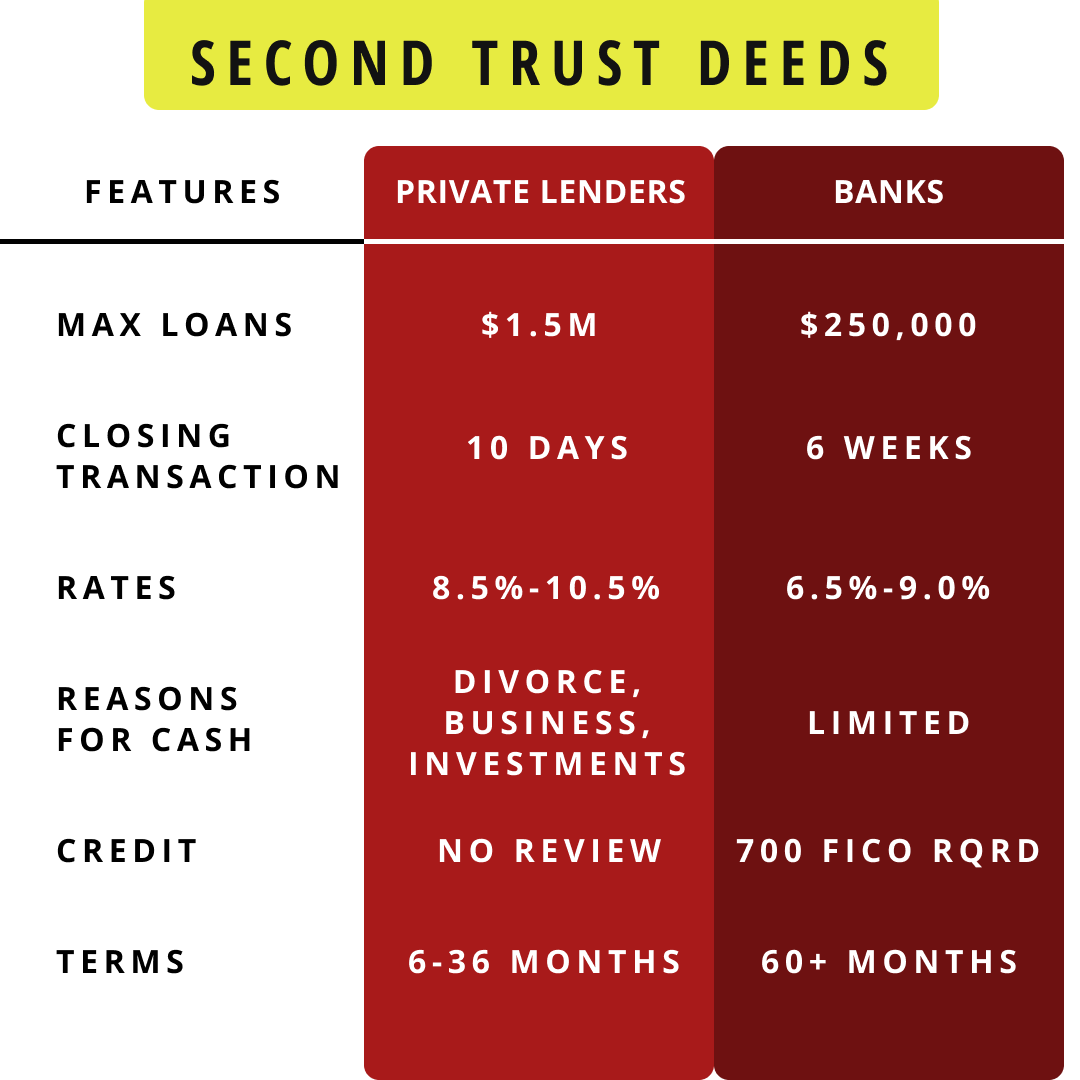

Private Money Second Trust Deeds offer so much more to the borrowing community than do banks. Consider the following:

As you can see, second trust deeds from private lenders offer substantial versatility compared to second trust deeds provided by banks.

There isn’t a project that you can’t accomplish with a $1.5 million max loan from a private money second trust deed. Furthermore, when time is of the essence, short closing and loan processing times with private money second trust deeds are the best financing options available.

How Private Client Investments, Inc Can Serve You

Private Client Investing is here for you if you require a second trust deed for a real estate loan in California. Private Client Investments, Inc offers seamless funding solutions through rigorous underwriting, due diligence, and attention to every detail. Through Private Client Investing, you can harness the power of private money second trust deeds to accomplish your financial objectives.